Folks Finance | Algorand Governance Strategies | Low, Medium, & High Risk | Bullish Bounty

$gALGO Bullish Bounty Submission #gALGObullish #Bounty

Algorand Governance Period #4 is upon us! At the time of writing this article, there is a little over 5 days left (July 14) to sign-up! Period #3 brought us some fantastic DeFi innovations that give Algorand Governors the ability to turn their illiquid governance stash into a liquid one!

In this article, I am going to lay out governance yield farming strategies that you could utilize, with the help of Folks Finance and their Liquid Governance - gALGO!

Liquid Governance has some fresh updates compared to last period: - continuous gALGO, rather than gALGO3, gALGO4 and so on for each period

- zero fees for Liquid Governance

- ability to claim governance rewards early

- ability to vote in Algorand governance

- ability to vote in Folks Finance Governance model

Their platform has quickly become my favorite and I plan on moving most of my ALGO governance stash over into their Liquid Governance system!

*To sign up for Liquid Governance through Folks Finance, use this button below:

(Website: Folks Finance)

This article is not meant to be a “how to” article. This article will begin by making these presumptions: that the reader understands what Algorand Governance is and that the reader is familiar enough with Folks Finance or similar dapps, to understand how to use it. If this is the first time you’ve heard about Algorand Governance, you can learn more about it here: https://algorand.foundation/governance. If you are uncertain how to use Folks Finance, check out this explainer video here below:

Now that we have that out of the way, let’s begin!

1.) Low Risk Strategies

Strategy A: (“A” being the “least” risky)

Step one of any strategy is to take your ALGO over to Folks Finance and mint gALGO. This automatically enrolls you into governance via Folks and entitles you to the Foundation’s governance rewards. Rewards are currently estimated to be around 39%, but this should come down as we approach the end up the sign up window. Last period was roughly 8%, so for the sake of simplicity, let’s assume that it will be about 8% again. Boosted rewards are around 10%, but that will likely decrease slightly as participation increases.

HODL (Simply hold your gALGO safely in your wallet)

Total estimated APR = ~8% + boosted Aeneas Foundation rewards ~10% = ~18%!

This is the safest way to participate via Folks Finance and guarantees you a roughly 8% APR return on your ALGO, plus boosted Aeneas rewards (10%). You can then unmint your gALGO at the end of the period.

Pros: - Grow Algorand TVL (Total Value Locked: Algorand’s current TVL can be found “here”)

- Ability to claim governance rewards early (always available to gALGO minters).

- Free to use gALGO anyway you wish (liquid governance stash)

Cons: - Smart contract vulnerability risk (this risk is applied to all strategies). All FIVE audits can be found here: https://docs.folks.finance/security/audits

Strategy B:

Take ALGO ——> Mint gALGO (~8% APR)

Supply 60% of your gALGO as collateral on Folks Finance

Borrow ALGO against your gALGO. (Since these can be considered “in kind” assets, you can max out your borrow rather safely)

Take the remaining 40% of your gALGO & your borrowed ALGO to Pact (Algorand DEX).

Pair ALGO & gALGO in a liquidity pool. (~4% APR)

Keep an eye out for liquidity incentives! Last period, Folks had boosted rewards for a ALGO/gALGO pool on Tinyman around 20-30% if I recall correctly.

Total estimated APR = 8% (governance) + 4% (Pact LP pool) + 10% (boosted rewards) = 22%

Pros: - Earn higher rewards

- Grow Algorand TVL

- Increase Liquidity

- Borrowing “in-kind” assets nearly* eliminates the risk of liquidation. Keep an eye on that borrow interest rate, however! Current ALGO borrow rate is 1.79% with up to 1.18% rewarded back to you as you repay the loan, which works out to roughly a 0.6% current borrow interest rate.

Cons: - You are less liquid than in strategy A, since funds are tied up in a liquidity pool. (Fortunately though, you can un-pool them at any time.)

- Compounding smart contract risk (Folks gALGO contract + Pact LP pool contract). Pact audit report: click *here*

- Interest rate on borrowed ALGO could increase, which could impact liquidation risk.

Strategy C:

Take ALGO ——> mint gALGO

Supply gALGO as collateral ——> borrow ALGO

Deposit ALGO onto Folks Finance ——> get fALGO in return

Stake fALGO on the “farm deposit” section of Folks Finance

Total estimated APR = 8% (governance) + 10% (Folks boost) + 9% (fALGO staking) = 27%

Pros: - More yield!

- Grow Algorand TVL

- Borrowing “in-kind” assets nearly eliminates the possibility of liquidation (again, keep an eye on interest rates though).

Cons: - Risk of Liquidation if interest accrual on borrowed ALGO outgrows the value of the collateral.

2.) Medium Risk Strategies:

Strategy A:

Take ALGO ——> mint gALGO

Supply gALGO as collateral ——> borrow goBTC

Bring borrowed goBTC over to Algofi

“Zap” goBTC into the goBTC/STBL LP pool

Go to the Algofi farm

Deposit LP tokens into the goBTC/STBL farm

Total estimated APR = 8% (governance) + 10% (Folks boost) + 15% (goBTC/STBL farm) = 33%

Pros: - More Yield!

- Grow Algorand TVL

- Increase Liquidity

- Can be used to “hedge” your portfolio. (Borrowing goBTC and then zapping it, effectively sells half of it for STBL. This means you would have a small short position open on goBTC.)

Cons: - Risk of liquidation or lower yield if markets move unfavorably (remember, this strategy not only includes borrowing, but also includes a short position on goBTC).

- Risk of impermanent loss. The impermanent loss risk has been near zero for all prior strategies, so I’ve yet to explain what impermanent loss is, but from here on out, you should familiarize yourself with the concept!

*To learn more about impermanent loss, check out these resources:

Whiteboard Crypto - What is Impermanent Loss?

Whiteboard Crypto - 6 Ways to Avoid Impermanent Loss

Strategy B:

Take ALGO ——> Mint gALGO

Supply gALGO as collateral ——> Borrow USDC

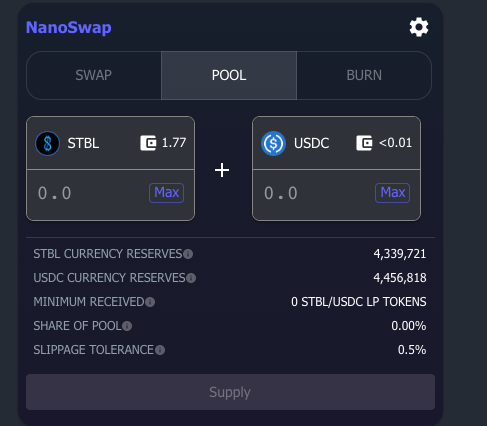

Take USDC to Algofi (here)

Use the “pool” function on the “nano swap” page to zap your USDC into the USDC/STBL liquidity pool.

Take LP tokens to the “Stability” tab on Algofi and deposit them into the USDC/STBL farm.

Total estimated APR = 8% (governance) + 10% (Folks Boost) + 18% (Algofi farm) = 36%

Pros: - More yield!

- Since LP is in stablecoins; little to zero risk of impermanent loss

- Grow Algorand TVL

- Increase Liquidity

Cons: - Risk of liquidation (If the value of supplied ALGO/gALGO nears the value of borrowed USDC, you risk liquidation)

- Interest rate on borrowed USDC could spike, decreasing yields and/or increasing the chance of liquidation.

Strategy C:

Take ALGO ——> mint gALGO

Supply gALGO as liquidity ——> borrow goETH

Take goETH to Algofi

“Zap” into goETH/STBL LP pool

Take LP tokens & deposit them into the goETH/STBL farm

Total estimated APR = 8% (governance) + 10% (Folks boost) + 20% (goETH/STBL farm) = 38%

Pros: - More Yield!

- Grow Algorand TVL

- Increase Liquidity

- Can be used to “hedge” your portfolio. (Borrowing goETH and then zapping it, effectively sells half of it for STBL. This means you would have a small short position open on goETH.)

Cons: - Risk of liquidation or lower yield if markets move unfavorably (remember, this strategy not only includes borrowing, but also includes a short position on goETH).

- Risk of impermanent loss!

- This is basically the same strategy as the goBTC strategy, but adds slightly more risk due to the fact that ETH is historically more volatile that BTC.

3.) High Risk Strategies:

Strategy A:

Take ALGO ——> Mint gALGO

Supply gALGO as collateral ——> borrow ALGO

Take borrowed ALGO —— Mint more gALGO

Repeat as much as desired or possible (I was able to turn 100 ALGO into nearly 370 gALGO with this loop method.)

Estimated total APR =

{8% (governance) + 10% (Folks boost)} x 3.7 (governance loop) = 67%

Pros: - Much higher yield!

- Grow Algorand TVL

- Not actually too risky (this could have been placed in medium risk category, but since it involved so much borrowing, I placed it here).

- Little risk of liquidation due to price swings, since collateral and borrow can be considered “in-kind” assets.

Cons: - Possible risk of liquidation or reduced rewards/yield if interest rate on borrowed ALGO goes too high

- This “looping” process requires a LOT of clicking and entering in your password MANY times. It is quite tedious.

**There’s more to come, but if you’ve made it this far, consider subscribing

to my substack! I plan to write more regular content!**

JT’s Newsletter is a reader-supported publication. To receive new posts

and support my work, consider being a paid subscriber. All proceeds

will go towards bringing more and better content.

Strategy B:

Take ALGO ——> Mint gALGO

Supply gALGO as collateral ——> Borrow USDC

Bring USDC over to Tinyman (DEX) found “here”

Tinyman Audits: “here” Swap USDC for ALGO (use Tinyman because it has the highest liquidity for this trade)

(Or check out DEFLY! Their comboswap feature will route your trade through various DEX pools to get you the best pricing!)

Take purchased ALGO to Folks ——> Mint more gALGO

Borrow more USDC and repeat the process until your comfortable (If you max it out, you can get around the same amount of gALGO as in “High Risk Strategy A” — 3.7x)

Estimated total APR =

{8% (governance) + 10% (Folks boost)} x 3.7 (governance USDC loop) = 67%

Pros: - Much higher yield!

- Grow Algorand TVL

- This strategy, though similar to “A” above it, is considered a “Long” position. This means that if the price of ALGO goes up during the time you do this strategy, you’ll benefit from outsized returns as well as high yield!

Cons: - Risk of liquidation if ALGO price goes down too far against borrowed USDC

- Possible risk of liquidation or reduced rewards/yield if interest rate on borrowed USDC goes too high

- This “looping” process requires a LOT of clicking and entering in your password MANY times. It is quite tedious.

Strategy C:

Take ALGO ——> Mint gALGO

Supply gALGO as collateral ——> Borrow USDC

Take USDC to Tinyman ——> Buy more Algo

Loop until gALGO is 2.5x the size of the original mint.

Borrow more USDC

Seek out high yield in the ecosystem (examples below)

Choose the pool you want to enter ——> Buy those two tokens with remaining USDC.

(Personally, I would choose the pBTC/ALGO pool on Tinyman, yielding 55%. As you can see, there is clearly higher yield available than that, but the pBTC/ALGO pool is “safer” in my mind, as all the other altcoins are MUCH more volatile.)

Estimated Total APR =

[{8% (governance) + 10% (Folks boost)} x 2.5] + 55% (pBTC/ALGO) = 100%

Pros: - Much higher yield!!

- Grow Algorand TVL!

- This strategy is a “Long” (you are long ALGO AND whichever tokens you purchased to yield farm (in this case pBTC & more ALGO), which means if asset prices increase, you will enjoy outsized returns as well as high yield.

Cons: - Risk of liquidation if ALGO or pBTC price goes down too far against borrowed USDC

- Possible risk of liquidation or reduced rewards/yield if interest rate on borrowed USDC goes too high

- This “looping” process requires a LOT of clicking and entering in your password MANY times. It is quite tedious.

- Possible Impermanent Loss from the pBTC/ALGO pool.

*To sign up for Liquid Governance through Folks Finance, use this button below:

Additional resources:

Long Position vs. Short Position: What's the Difference? - Investopedia (click here: link)

Folks Finance Docs: https://docs.folks.finance/

What Is Leverage? - Investopedia (click here: link)

I hope you’ve found this helpful so far! If you have, please share the newsletter and be sure to tag Folks Finance and myself when you share it! Also, follow me on Twitter and Youtube if you aren’t doing so already. Lastly, consider donating to show your appreciation and support!

Algorand Donations:

PIFQZTXED5YVLDLVA2FYGEAONJZNR2M6BOHND4JW3JKOPAWEPXS7JYHSHE

or via NFD: jtinvestsinyou.algo

This wallet can accept a whole host of algorand assets including ALGO, USDT, USDC, PLANETS, goBTC, goETH, DEFLY, HDL, YLDY, XET, OPUL, goMINT, STBL, WBLN, & AKTA

**Please note** Borrowing is very risky. Leverage is risky. Some of these strategies may not be suitable for every investor. Please manage risk according to your own risk appetite. I am not responsible for the actions you take. Also, all APRs included in this article are ESTIMATES. Some APRs have changed slightly while writing this article (for example: Folks Aeneas boost was 10.3% when I began writing this but has come down to 9.5% upon completion of this article and could be down even more by the time you read this. It should also be noted that smart contract risk is present at all times in DeFi.**

***BUT WAIT, THERE’S MORE!***

I have one last, HIGH RISK, strategy that involves a SHORT position and the purchase of a new asset class uncorrelated to crypto! To learn about this last strategy, become a paid subscriber to the newsletter! This last strategy has high yields, hedges against the market (short position & uncorrelated assets), along with a new passive income stream. Subscribe now to find out what it is!

Keep reading with a 7-day free trial

Subscribe to JT’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.